Does My Business Need Cyber Security Insurance?

In an era where cyber threats are constantly evolving, businesses must ask themselves: Is cyber insurance a necessity?

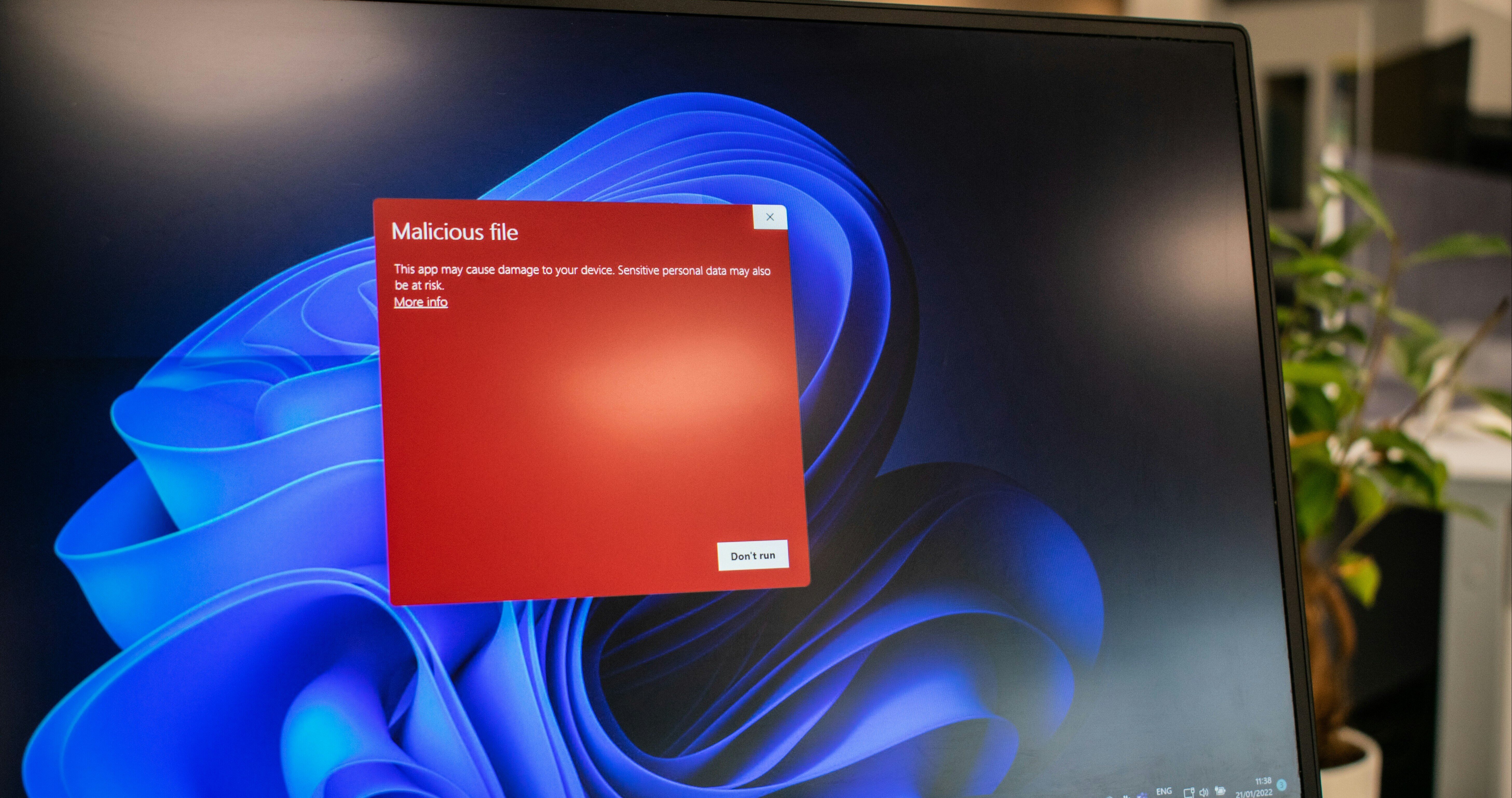

In today's digital age, cyber threats are evolving at a pace faster than most businesses can keep up with. From phishing attacks and ransomware to data breaches and insider threats, the spectrum of cyber risks is broad and constantly shifting. The modern cyber threat landscape is not just a concern for large corporations; small to medium-sized businesses are increasingly becoming prime targets due to perceived vulnerabilities.

With the rise of remote work and dependency on digital infrastructure, the attack surface for cybercriminals has expanded significantly. Every business, regardless of size or industry, must recognize that a cyber attack is a real and present danger.

The Financial Impact of Cyber Attacks on Businesses

The financial repercussions of a cyber attack can be devastating. Direct costs can include ransom payments, legal fees, and regulatory fines, while indirect costs might encompass lost business, reputational damage, and the expense of restoring affected systems and data. For many small to medium-sized enterprises, the financial strain of a significant cyber incident can be insurmountable.

In fact, recent studies have shown that nearly 60% of small businesses close within six months of a cyber attack. This statistic highlights the critical importance of not only having robust cybersecurity measures in place but also possessing a financial safety net to recover from such incidents.

What Cyber Insurance Covers and Why It's Essential

Cyber insurance acts as a financial safety net for businesses, covering a variety of costs associated with cyber incidents. Policies typically include coverage for data breaches, business interruption, legal fees, and even public relations efforts to manage reputational damage. This type of insurance is essential because it provides businesses with the resources needed to respond to and recover from cyber attacks effectively.

Without cyber insurance, businesses may find themselves in a precarious financial situation following an attack. The peace of mind that comes with knowing your business is protected against potential cyber threats cannot be overstated.

Evaluating Your Business's Cyber Security Posture

Understanding your business's current cybersecurity posture is the first step towards robust protection. This involves evaluating your existing security measures, identifying potential vulnerabilities, and implementing necessary improvements. Regular risk assessments, employee training, and the adoption of best practices in cybersecurity are crucial components of a strong defensive strategy.

Moreover, businesses should ensure they are up to date with the latest security technologies and protocols. This proactive approach not only minimizes the risk of a successful attack but also positions your business favorably when applying for cyber insurance.

Partnering with Sentry Technology Solutions to Navigate Cyber Security Decisions

Navigating the complex world of cyber security and cyber insurance can be daunting, but you don't have to do it alone. Sentry Technology Solutions is here to be your trusted partner. We understand the intricacies of cyber insurance and know exactly what insurance companies are looking for when assessing your business's risk profile.

Our team of experts is dedicated to providing innovative, supportive, and professional guidance as you bolster your cybersecurity measures and explore insurance options. With Sentry by your side, you can confidently protect your business against the evolving cyber threat landscape, ensuring your operations remain secure and your future is safeguarded.