Data Security Across Multiple Franchise Locations

Franchise leaders are discovering that protecting customer data across multiple locations isn't just about avoiding the $4.88 million average breach cost—it's about building a security strategy that scales with growth while maintaining brand trust.

What's in this article:

- Why Franchise Data Security is Uniquely Complex

- The Real Cost of a Data Breach for Multi-Location Businesses

- The Most Common Security Vulnerabilities in Franchise Operations

- PCI DSS Compliance: What Franchises Must Know in 2025

- Building a Centralized Security Strategy Across Locations

- How Sentry Protects Franchise Networks

Running a franchise means juggling an inherently complex security puzzle that single-location businesses never face. You're not just protecting one building with one network and one team—you're securing a distributed ecosystem where each location introduces new variables.

The franchise security challenge looks like this:

Multiple locations mean multiple networks, each requiring individual protection while maintaining centralized oversight. Your Des Moines location might have completely different IT infrastructure than your Phoenix location, yet both handle the same sensitive customer payment data.

Distributed responsibility creates gaps in accountability. When security falls between corporate oversight and franchisee autonomy, critical vulnerabilities slip through unnoticed. 46% of all cyber breaches impact businesses with fewer than 1,000 employees—exactly where most franchisee operations sit.¹

Varied security practices across locations make consistency nearly impossible to achieve manually. One franchisee might have excellent security habits while another unknowingly creates backdoors for attackers through outdated software or weak passwords.

Centralized risk meets distributed operations. A breach at any single location doesn't just affect that franchisee—it threatens your entire brand reputation. When customers see your brand name attached to a data breach headline, they don't distinguish between corporate and franchisee responsibility.

The Real Cost of a Data Breach for Multi-Location Businesses

The numbers around data breaches should make every franchise leader pay attention. In 2024, the average cost of a data breach hit $4.88 million, representing a 10% increase from the previous year.² For franchises specifically, this figure takes on even more devastating proportions.

Breaking down the true financial impact:

| Cost Category | Small Business Impact | Multi-Location Impact |

|---|---|---|

| Direct Breach Costs | $120,000 - $1.24M | $3.3M - $4.88M |

| Recovery Timeline | 6-12 months | 7.3 months average |

| Customer PII Exposure Cost | $160 per record | Compounds across locations |

| Business Closure Rate | 60% within 6 months | Varies by system strength |

Small businesses face particularly brutal consequences. 60% of small companies completely shut down within six months of experiencing a cyberattack.³ For franchise locations operating as small businesses under your brand umbrella, this statistic should terrify you.

The costs extend far beyond the immediate breach response. Lost business represents one of the costliest segments of data breach impact. Customers who lose trust in your brand after a breach don't just stop coming to the affected location—they avoid your entire franchise network.

Legal and compliance penalties compound the financial damage. With PCI DSS 4.0 requirements now fully enforced as of March 2025, non-compliance can result in fines ranging from $5,000 to $100,000 per month.⁴ For franchises processing payments across multiple locations, these penalties multiply quickly.

Insurance premiums skyrocket after a breach. Even if you have cyber insurance, providers now require proof of implemented security measures. Following a breach, businesses face significant premium increases as their risk profile changes. Some insurance claims may be denied entirely if adequate security measures weren't in place before the breach.

The Most Common Security Vulnerabilities in Franchise Operations

Understanding where franchises are most vulnerable helps you prioritize your security investments. Cybercriminals know exactly where franchise operations are weakest—and they exploit these vulnerabilities repeatedly.

Compromised credentials lead the pack. Phishing attacks and stolen employee passwords represent the most frequent breach method across franchise operations. These attacks take the longest to identify and contain, averaging over 200 days before discovery.⁵ During those months, attackers have free access to move laterally across your network, potentially compromising multiple locations.

Point-of-sale systems create obvious targets. Every franchise location processing card payments maintains a treasure trove of payment data. Outdated POS systems, especially those running unsupported software, practically invite attackers. Once compromised, a single POS terminal can expose card data from thousands of customers.

Cloud misconfigurations rank as the third most common breach source. As franchises increasingly rely on cloud-based systems for inventory, scheduling, and customer management, misconfigured cloud storage becomes a critical vulnerability. 82% of all data breaches involve data stored in the cloud, whether public or private.⁶

Human error drives 95% of cybersecurity breaches.⁷ Your team members at each location—from shift managers to new hires—can accidentally create security gaps through simple mistakes like clicking suspicious links, using weak passwords, or mishandling sensitive data.

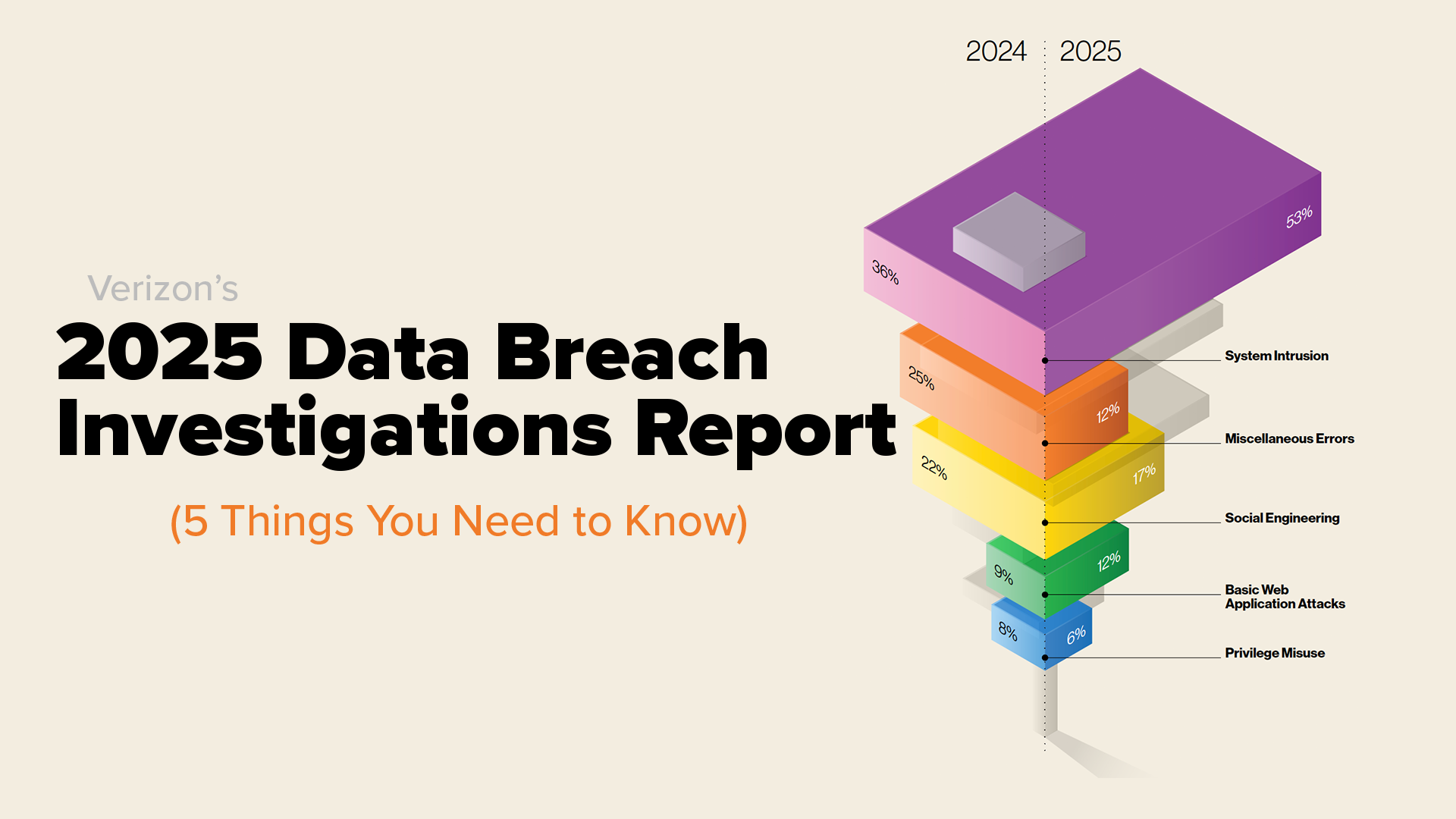

Third-party vendor compromises affect 36% of all data breaches, up 6.5% year-over-year.⁸ Your franchise locations likely work with multiple vendors—from payment processors to delivery services. Each vendor relationship creates another potential breach pathway into your network.

PCI DSS Compliance: What Franchises Must Know in 2025

Payment Card Industry Data Security Standard (PCI DSS) compliance isn't optional—it's a baseline requirement for any business processing credit card payments. For franchises, PCI compliance becomes exponentially more complex when scaled across multiple locations.

The 2025 compliance landscape has fundamentally changed. PCI DSS 4.0 became fully mandatory on March 31, 2025, ending all grace periods for previously "best practice" requirements. The standard grew from 370 to over 500 requirements, with 47 becoming immediately mandatory.⁹

Multi-factor authentication (MFA) is now required for all access into the cardholder data environment. This means every employee at every location accessing payment systems needs MFA—no exceptions. For franchises, implementing and maintaining MFA across dozens of locations requires centralized management and consistent enforcement.

Payment page script security demands continuous monitoring. Requirements 6.4.3 and 11.6.1 require franchises to maintain a complete inventory of all scripts on payment pages, document authorization for each script, and continuously verify their integrity. This isn't a quarterly review—it's real-time, 24/7 monitoring.

Automated log reviews replace manual processes. Manual log reviews can't keep pace with the volume of data generated across multiple franchise locations. PCI DSS now mandates automated audit log reviews for all cardholder data environment components, typically requiring SIEM (Security Information and Event Management) solutions.

The shared responsibility between franchisor and franchisee creates compliance complexity. Research reveals that 92% of independently owned and operated locations lack meaningful data security programs.¹⁰ When your brand transmits reservation information, customer data, or cardholder information to non-compliant franchisees, who bears the responsibility?

The PCI Security Standards Council's guidance on third-party security makes it clear: security is a shared responsibility. Brands cannot distance themselves from franchisee non-compliance. You need clear documentation outlining who handles each specific security control—from network security to access management to incident response.

Building a Centralized Security Strategy Across Locations

Protecting a franchise network requires a fundamentally different approach than securing a single business. You need centralized oversight with localized implementation—a security strategy that scales across every location while adapting to each franchisee's specific environment.

Start with centralized visibility. You can't protect what you can't see. Implement security monitoring tools that provide corporate-level visibility into every location's security posture. This means real-time monitoring of network activity, automated threat detection, and centralized logging across all franchise locations.

Standardize security requirements in your franchise agreements. Make specific security controls mandatory for all franchisees—not suggestions, but requirements. This includes:

- Network firewalls at every location

- Encrypted data transmission for all payment processing

- Regular security updates and patch management

- Multi-factor authentication for all system access

- Automated backup systems with off-site storage

Create security policies that actually get followed. Policies buried in 100-page operations manuals don't protect your franchise. Develop clear, concise security standards that franchisees understand and can implement. Regular security awareness training should be mandatory, not optional.

Implement network segmentation to contain potential breaches. Separate sensitive payment data from general business operations at the network level. If one system gets compromised, segmentation prevents attackers from accessing everything.

Deploy automated security updates across your network. Waiting for individual franchisees to manually update their systems creates dangerous security gaps. Centralized patch management ensures every location runs current, secure software versions.

Build incident response protocols before you need them. When—not if—a security incident occurs, every minute counts. Your response plan should clearly define:

- Who gets notified immediately when a breach is detected

- How affected locations isolate compromised systems

- Communication protocols for customers and stakeholders

- Evidence preservation procedures for potential legal action

- Recovery steps to restore normal operations quickly

Regular security audits keep your defenses current. Don't wait for your annual compliance assessment to discover vulnerabilities. Conduct quarterly security reviews across a rotating selection of franchise locations, identifying and addressing gaps proactively.

How Sentry Protects Franchise Networks

At Sentry Technology Solutions, we understand that franchise security isn't just about installing firewalls and hoping for the best. It's about creating a comprehensive security ecosystem that protects every location while giving you centralized visibility and control.

We've spent over a decade helping franchise organizations navigate complex cybersecurity challenges. Our approach recognizes that you need more than technology—you need a trusted partner who understands the unique pressures franchise leaders face.

Our AI-powered tools and automations secure your digital assets 24 hours a day across every location. We monitor your network constantly, identifying threats before they become breaches. When we detect suspicious activity, our systems respond immediately—not waiting for someone to notice something wrong hours or days later.

We don't just point out problems—we solve them permanently. Many technology providers identify issues and leave you to figure out implementation. We partner with you to address root causes, implementing solutions that protect your franchise today while scaling with your growth tomorrow.

Our team helps you achieve and maintain PCI DSS compliance across your entire franchise network. From initial compliance assessments to ongoing monitoring and documentation, we handle the technical complexities so you can focus on running your business. We become your single point of contact for technology security, eliminating the chaos of managing multiple vendors across multiple locations.

For franchises looking to scale securely and efficiently, Sentry brings strategic technology solutions tailored to your specific operational model. We've worked with businesses just like yours, and we know exactly what keeps franchise leaders up at night. Learn more about how we help franchise businesses protect their multi-location operations at our Cybersecurity page and explore our comprehensive approach to Franchise Technology.

Don't let another day go by without being a leader who goes to sleep at night knowing your franchise network is fully protected. The cost of a data breach—financially, operationally, and reputationally—is too high to leave security to chance.

Your customers trust you with their payment information at every location bearing your brand name. That trust deserves protection backed by enterprise-grade security, centralized management, and partners who understand franchise operations.

Schedule a discovery call with Sentry today to learn how we can help protect your franchise empire from growing cyber threats while simplifying your compliance obligations across every location.

References

- Plante Moran, "Cybersecurity essentials for franchises," 2024

- IBM Security, "Cost of a Data Breach Report," 2024

- Verizon, "Data Breach Investigations Report," 2024

- PCI Security Standards Council, "PCI DSS 4.0 Requirements," 2025

- UpGuard, "Cost of a Data Breach in 2024"

- IBM Security, "Cost of a Data Breach Report," 2024

- Ponemon Institute, "Cost of Insider Threats Report," 2024

- Secureframe, "Data Breach Statistics," 2025

- Feroot Security, "PCI DSS 4.0.1 Compliance Checklist," 2025

- PrivacyAtlas via Viking Cloud, "PCI DSS Chaining and Franchise Relationships"